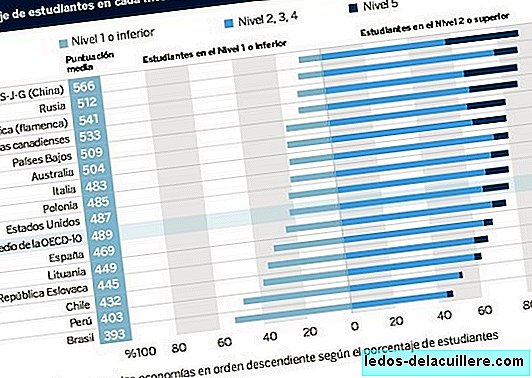

The conclusions of the 2015 OECD PISA Report (Program for International Student Assessment) on financial competencies in which 48,000 15-year-old youth participated. Unlike the global PISA report involving 71 countries and evaluates different areas, 15 countries participated in this edition and were evaluated the knowledge that young people have about finance.

The objective is to know the level of knowledge and skills of young people to face financial decision making. In this edition, young Spaniards get 469 points, 15 less than in the previous edition of 2012 (484), standing in the tenth position of the participating countries. According to the results, one in four Spanish students cannot read an invoice or that more than half are not able to interpret a bank statement.

The most competent countries

China, Russia and Belgium They are the countries that top the list of the most competent in financial education.

Countries like Canada or the Netherlands, which have just joined the report, are also in the top positions. On the other hand, countries like Italy and Russia, have significantly improved their results and are above the average of the participating countries.

Students are classified into five levels. According to the PISA 2015 report, 22% of the students surveyed were not able to make simple decisions about their daily expenses (level 1, the lowest). And only 12% could understand complex financial products, such as calculating compound interest (level 5, the most advanced).

In the case of Spain, 5.6% of the surveyed students stood at the latter level, which represents an improvement of 3.2 points compared to 2012, but represents half of the OECD average. Although this data is positive, the counterpart is that the number of students at level 1 has increased, which has gone from 16.5% to 24.7%.

We only surpass Lithuania, Slovakia, Chile, Peru and Brazil.

Is a subject about finance necessary?

Although the results are worrying, the OECD sees "premature" talk about a compulsory subject on finance in Spain. Instead, it proposes as a solution to strengthen initiatives in financial education in schools.

"Doing the obligatory things always creates resistance, especially in an issue such as financial competition, until one does not demonstrate the value of the programs, venturing to make it mandatory in the case of Spain, the same is a bit premature," said the deputy director Office of the Secretary General of the OECD, Juan Yermo, in statements to Europa Press.

It recommends providing complementary training avenues to improve practical learning in classrooms reinforced with innovative formats, such as video channels, video games or simulators. The study also highlights the importance of parent training in financial matters since they are the main transmitters of this knowledge to their children.

Tips to start educating them in finance

Of course, we do not expect our children to be financial analysts with ten years, but it is important to start educating them in the world of finance since they are young. These are some basic financial notions for children that you can start putting into practice.

Enter the money concept, explain how it is obtained and what it is for.

Explain how the value of things and the exchange of goods and services are quantified.

Teach them from small to not waste and consume responsibly.

Teach them the importance of saving. If they want to buy something, they will have to save.

You can teach them how to carry a control of its own economy, writing down the income (the pay, the money that the grandparents or the uncles give him) and the expenses that they are having.

You can play the child owns a store or restaurant and he has to manage the money he has. As it grows, you can incorporate more complex concepts such as a bank account, invoices, loans or interest.